AI/ML Ops

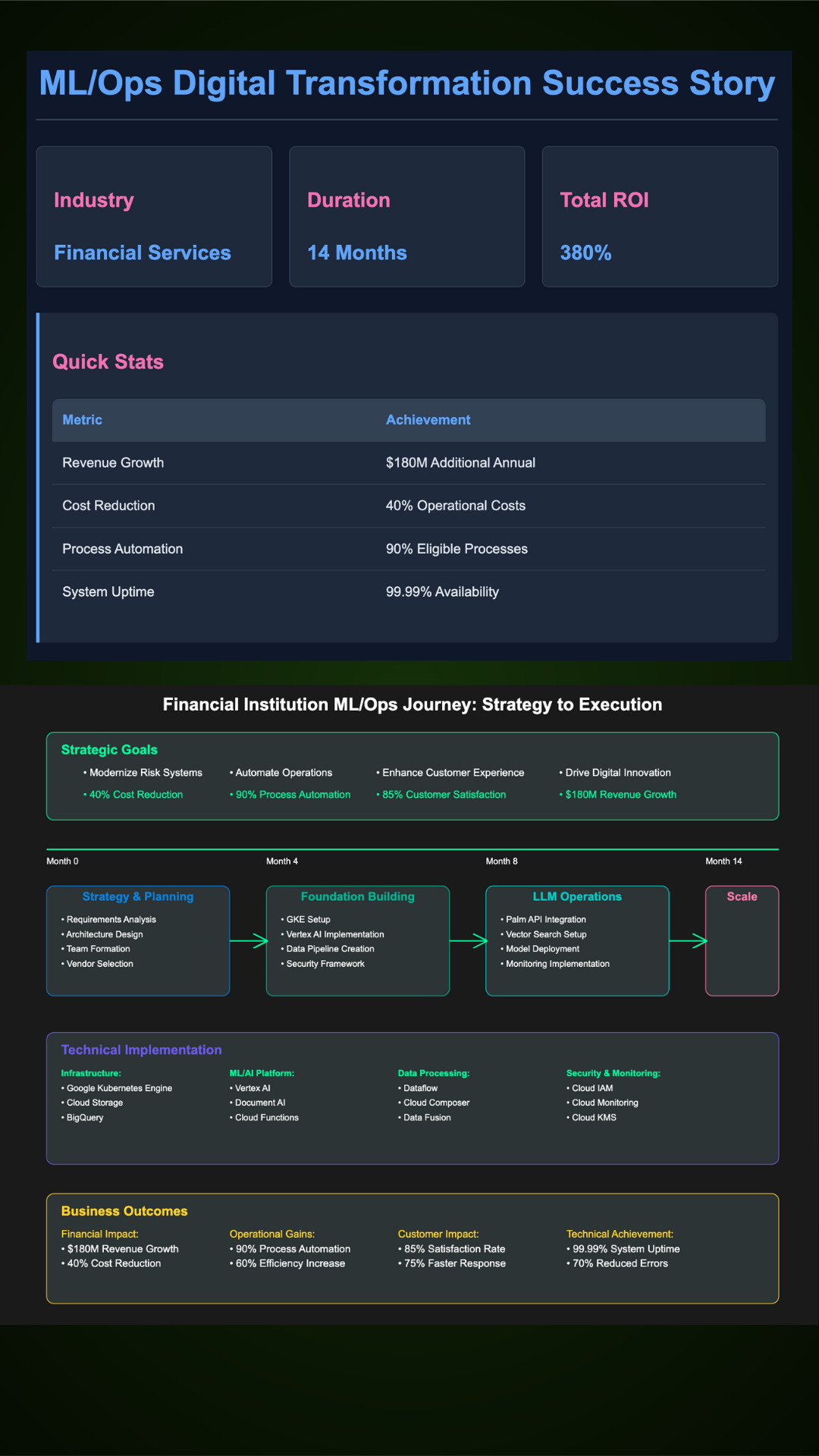

A leading global financial institution initiated a digital transformation to modernize operations through AI/ML, Large Language Models (LLMs), and effective MLOps practices. The project established a unified MLOps platform for standardized model development, enabling CI/CD while ensuring governance and model reproducibility.

This transformation utilized advanced AI algorithms for fraud detection and credit scoring, resulting in a 40% decrease in false positives and a 35% enhancement in risk assessment accuracy. The MLOps framework supported rapid model iterations and A/B testing, with automated systems monitoring model performance in real-time.

Customer service improved significantly with intelligent chatbots managing over 60% of routine inquiries. The MLOps pipeline allowed for timely model updates based on customer interaction data, enhancing response accuracy. Their ML market analysis tools and robo-advisory services advanced wealth management with reliable performance through automated validation and deployment.

In compliance and risk management, LLMs with automated governance workflows reduced document processing time by 75%. The MLOps infrastructure offered audit trails and model lineage tracking for regulatory compliance. This integrated AI approach streamlined deployment, increased reliability, and built a scalable foundation for future initiatives.

- Industry: Financial Services

- Role: Vice President - AI/ML

- Number of Team Members: 18

The implementation of AI and machine learning within our organization has fundamentally transformed traditional product lines through enhanced fraud detection mechanisms, automated credit evaluations, and sophisticated customer service solutions. The extensive utilization of robo-advisors and predictive analytics has optimized wealth management processes and improved market forecasting capabilities.

Chief AI Officer